A reader asks about the seasonal chart. Here is a simpler version.

The seasonality is defined as the percent change from the beginning of year to the end of each month.

monthlychange[stock_, year_] :=

Module[{data, firstdateprice, endofmonthprice},

data = FinancialData[stock, "Close", {{year, 1, 1}, {year, 12, 31}}];

data = Map[Flatten[#] &, data]; firstdateprice = data[[1, 4]];

endofmonthprice = Table[Last@Select[data, #[[2]] == i &][[All, 4]], {i, 12}]; (endofmonthprice/firstdateprice - 1)*100]

This will give you the monthly change of AAPL in the year of 2008.

monthlychange["AAPL", 2008]

For multiple years, the average seasonality:

mc = monthlychange["AAPL", #] & /@ Range[2000, 2008];

Mean@mc

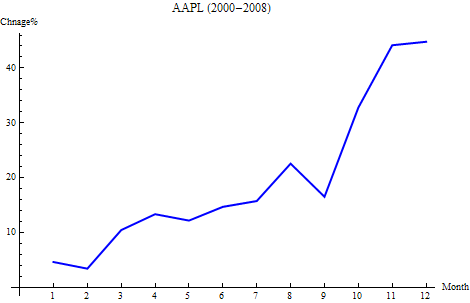

For APPL, the following graph shows the average seasonality from 2000 – 2008. According to this graph, it is probably a good idea to hold the stock through Oct and Nov before selling it.

This is a graph shows the seasonality year by year.

2 comments:

Thank you - this helps a lot!

Cheers, Holger

I think you got your sums wrong in 2008 aapl started the year with a price nigh on $200 and ended it with a price of $80 the return on all but a few months is negative. Your graph shows positive returns. There must be something wrong...

Post a Comment